Business

Wema Bank Rocked By Crisis Over ‘Moves’ To Hire New CEO

Wema Bank Rocked By Crisis Over ‘Moves’ To Hire New CEO

A major crisis has reportedly engulfed Wema Bank Plc over who takes over from Mr Ademola Adebise, the current Chief Executive Officer (CEO), who is allegedly being forced to retire by the board of the financial institution.

It was gathered that the crisis may sink the financial institution if nothing is done to resolve it urgently.

Adebise, whose first tenure expires in October, having made the substantive MD/CEO of Wema Bank on October 1, 2018, has been served notice of retirement from the bank.

“There is serious infighting among the top echelon of the bank as different camps scheme to take over the leadership of the commercial lender,” a source said.

RELATED STORY: BREAKING: Brazilian Soccer Legend, Pelé Is Dead

Thenewstable gathered that the Deputy Managing Director, Moruf Oseni is the likely successor of the outgoing CEO.

But sources revealed that the interests from the bank’s top shareholders might prevent Oseni from taking over as the next CEO of Wema Bank Plc which is jointly owned by various business groups.

Extracts from the 2021 financial year of the bank revealed that Neemtree Limited, SW8 Investment Limited, Petrotrab limited and Oduá Investment Company, hold substantial interest in the bank.

Neemtree Limited with Babatunde Kasali (current Chairman) & Abolande Metei-Okoh as representative have a holding of 10,835,509,443 or 28.09 per cent, while SW8 Investment Ltd with Adeyemi Adefarakan as a representative has 5,745,816,867 or 14.90 per cent holding of the bank.

Others are Petrotrab limited with 3,295,880,000 or 8.54 per cent shareholdings and Odu’a Investment, with 3,060,643,134 has Olusegun Adesegun as a representative on the board.

As of 2021, Kasali has 10,835,508,506,943 indirect holdings in Wema bank, while Abolanle Matel-Okoh has 1,750,000,000 and 10,833,506,943 direct and indirect holdings in the bank.

Abubakar Lawal in 2021 had 1,000,000 and 427,917,143 direct and indirect holdings; Olusegun with 3,060,643,134 and Adeyemi Adefarakan with 5,745,816,867 indirect holdings in 2021 respectively.

Other key holders include: Mr Ademola Adebise with 10,265 direct and 2,243,208 indirect; Mr. Adebode Adefioye with 6,988 direct holdings; Oluwole Ajimisinmi has 6,179,996 direct holdings and Emeka Obiagwu with 231,250 direct holdings in 2021.

Wema Bank’s performance under Adebise witnessed a significant improvement between 2018 and 2021 financial year.

The bank’s profit before tax grew significantly by 157.99 per cent to N12.38billion in 2021 from N4.8billion in 2018, while profit after tax increased by 168.35 per cent to N8.9billion in 2021 from N3.33billion reported in the 2018 financial year.

With the growth in profits, the bank for the first time in over a decade declared dividend payout to shareholders in 2018.

The growth in profit was driven by effective management of balance sheet as total assets increased from N488.8billion in 2018 to N1.18trillion reported in 2021.

As customers’ deposit hits N927.47billion in 2021 from N369.2billion in 2018, loans to customers moved from N252.19billion in 2018 to N418.86billion in 2021.

Wema Bank Rocked By Crisis Over ‘Moves’ To Hire New CEO

Business

NNPC Denies $6.8 Billion Debt Allegation and Defends Federation Account Remittances

NNPC Denies $6.8 Billion Debt Allegation and Defends Federation Account Remittances

On Sunday, the Nigerian National Petroleum Company Limited (NNPC Ltd) refuted claims of a $6.8 billion debt to international traders. In a statement, Olufemi Soneye, Chief Corporate Communications Officer, clarified that the company does not owe the reported sum.

The NNPC Ltd’s response followed allegations that it has not contributed any funds to the Federation Account since January. Soneye emphasized that such claims are false, asserting that the company and its subsidiaries consistently remit taxes to the Federal Inland Revenue Service (FIRS).

Soneye explained that while NNPC Ltd manages numerous open trade credit lines, it adheres to a first-in-first-out payment approach for its obligations. He also highlighted that the company is a major contributor to the Federation Account Allocation Committee (FAAC) through its tax contributions.

Regarding the quality and quantity of imported petroleum products, Soneye clarified that NNPC Ltd does not oversee these matters, as this falls under the purview of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), an independent body.

The statement reinforced NNPC Ltd’s commitment to transparency and accountability, in line with the company’s TAPE (Transparency, Accountability, and Performance Excellence) philosophy.

Business

Naira rebounds, gains N28.15 against dollar

Naira rebounds, gains N28.15 against dollar

The Naira on Tuesday closed the month of April on a good footing as it gained N28.15 at the official market, trading at N1,390.96 to the dollar.

Data from the official trading platform of the FMDQ Exchange, a platform that oversees the Nigerian Autonomous Foreign Exchange Market (NAFEM), revealed that the gain represented a 1.98 per cent appreciation for Naira.

The percentage increase is significant when compared to the previous trading date on Monday, April 29.

The local currency experienced about two weeks steady fall by exchanging at N1,419 to a dollar.

The success story was replicated in the volume of currency traded, as the total daily turnover increased.

The daily turnover stood at 225.36 million dollars on Tuesday up from 147.83 million dollars recorded on Monday.

Meanwhile, at the Investor’s and Exporter’s (I&E) window, the Naira traded between N1,450 and N1,200 against the dollar.

Naira rebounds, gains N28.15 against dollar

Business

Naira appreciate, gains further by 1.8% against dollar

Naira appreciate, gains further by 1.8% against dollar

The Naira experienced a further appreciation at the official market, trading at N1,382.95 to a dollar on Tuesday.

Data from the official trading platform of the FMDQ revealed that the Naira strengthened by N25.09 or 1.78 per cent, compared to the previous day’s rate of N1,408 against the dollar.

Read Also: Pay Hajj Fare Based On Dollar Exchange Rate, NAHCON Advises Pilgrims

However, the total turnover increased to $245.58 million on Tuesday, up from $222.15 million recorded on Monday.

Meanwhile, at the Investor’s and Exporters’ (I&E) window, the Naira traded between N1,486 and N1,300 against the dollar.

The reports gathered that the Central Bank of Nigeria(CBN) had, earlier on Tuesday at its 294th Monetary Policy Committee (MPC), raised Monetary Policy Rate (MPR), by 200 basis points from 22.75 per cent to 24.75 per cent.

CBN governor Yemi Cardoso said that was meant to tackle the nation’s rising inflation.

Naira appreciate, gains further by 1.8% against dollar

-

Business1 year ago

Business1 year agoNew Rates: ‘I borrowed money to finance this business…’ – Petroleum Marketer cries out over Non-supply of products by the NNPCL

-

Health5 months ago

Health5 months agoOnly 58,000 doctors renewed licence out of 130,000 registered doctors – MDCN

-

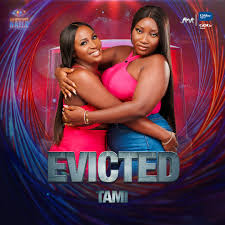

Entertainment2 months ago

Entertainment2 months agoBBNaija Season 9: TAMI Duo Evicted After Low Vote Count

-

Defence & Security1 month ago

Defence & Security1 month agoOrganisers Demand IGP’s Dismissal Over Fatal Protest Crackdown

-

Defence & Security1 month ago

Defence & Security1 month ago“Defence Chief Praises Strong Inter-Service Cooperation for Operational Successes”

-

Business2 years ago

Business2 years agoNew Naira Notes: We Have No Information On The Supreme Court Ruling – CBN

-

Opinion2 years ago

Opinion2 years agoAddressing Nigeria’s food security challenge through eco-friendly agriculture

-

Weather2 months ago

Weather2 months agoNiMet Forecasts 3 Days Thunderstorms, Rain Nationwide