Economy

We paid N142m claims in 2022, says Guinea Insurance CEO

We paid N142m claims in 2022, says Guinea Insurance CEO

Guinea Insurance Plc, on Tuesday said that it settled a total claim of N142 million in 2022, which indicated 194.63 per cent increase over the N48.2 million recorded in 2021.

The Chairman of Board of Directors, Guinea Insurance, Mr Ugochukwu Godson, said this at the company’s 65th Annual General Meeting (AGM) held in Lagos.

Godson said that the claims settlement was in fulfilment of the insurer’s obligations to policyholders.

He said that the insurance company also recorded a significant increase in its Gross Premium Income, from N1.34 billion in 2021 to N1.39 billion in 2022, which signified 3.73 per cent increase.

The chairman said that the firm’s growth in Net Premium Income was also notable, as it increased to N960 million in 2022, representing 9.18 per cent increase over N879 million recorded in 2021.

Read Also: Police Warn Against False Alarm, Mob Action Over Missing Genital Organs

He said that in 2022, the company’s Gross Premium Written rose to N1.36 billion, indicating a slight increase of 22 per cent over the N1.36 billion recorded in 2021.

“This growth could be attributed to the company’s expansion into new markets, as well as improved underwriting and risk management practices.

“However, in order to deliver on its single-minded pursuit of sustainable success and growth, the company evolved and implemented certain expansion plans,” he said.

According to him, the company’s expansion initiatives are vital, necessitating substantial upfront expenses such as increased operating costs, capital investments, research and development expenditures.

Godson said that the factors had a temporary impact on the company’s financial performance, leading to a notable increase in the Loss After Tax.

He added that specifically, the loss after tax rose from N23.4 million in 2021 to N64.7 million in 2022, amounting to a significant surge of 176.50 per cent.

The chairman revealed that the income tax expense in 2022 was N7.9 million, showing a significant drop of 78.40 per cent, compared to N36.5 million recorded in 2021.

He attributed this to effective tax planning strategies implemented by the company.

Godson reaffirmed the unwavering commitment of the board and management of the underwriting firm to position the company as an attractive investment company that is charting a course towards profitability.

According to him, the financial performance for the year under review reveals promising trends for Guinea Insurance.

Commenting, the Chief Executive Officer, Guinea Insurance, Mr Ademola Abidogun, said that the underwriter had listed 1,8 billion ordinary shares of 50 Kobo each at 50 Kobo per share on the Nigerian Exchange Ltd. (NGX).

Abidogun said that the total issue and fully paid-up shares of Guinea Insurance Plc had now increased from 6.14 billion to 7.94 billion ordinary shares of 50 Kobo each.

He said that the move aligned with the company’s proactive approach to securing future growth, increased market share and maximised returns for investors and partners.

“Guinea Insurance Plc is fully prepared to make the most of this opportunity, with more available funds to further strengthen our market position and enhance customer experience.

“The underwriter will also engage more in the core business of insurance, specifically underwriting, which involves collecting businesses, underwriting businesses, and making profit,” he said.

We paid N142m claims in 2022, says Guinea Insurance CEO

Business

NNPC Denies $6.8 Billion Debt Allegation and Defends Federation Account Remittances

NNPC Denies $6.8 Billion Debt Allegation and Defends Federation Account Remittances

On Sunday, the Nigerian National Petroleum Company Limited (NNPC Ltd) refuted claims of a $6.8 billion debt to international traders. In a statement, Olufemi Soneye, Chief Corporate Communications Officer, clarified that the company does not owe the reported sum.

The NNPC Ltd’s response followed allegations that it has not contributed any funds to the Federation Account since January. Soneye emphasized that such claims are false, asserting that the company and its subsidiaries consistently remit taxes to the Federal Inland Revenue Service (FIRS).

Soneye explained that while NNPC Ltd manages numerous open trade credit lines, it adheres to a first-in-first-out payment approach for its obligations. He also highlighted that the company is a major contributor to the Federation Account Allocation Committee (FAAC) through its tax contributions.

Regarding the quality and quantity of imported petroleum products, Soneye clarified that NNPC Ltd does not oversee these matters, as this falls under the purview of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), an independent body.

The statement reinforced NNPC Ltd’s commitment to transparency and accountability, in line with the company’s TAPE (Transparency, Accountability, and Performance Excellence) philosophy.

Economy

Revenue Commission Discloses Senators’ N1M Monthly Salary, N12M Allowances; Highlights Disparity with N70,000 Minimum Wage

Revenue Commission Discloses Senators’ N1M Monthly Salary, N12M Allowances; Highlights Disparity with N70,000 Minimum Wage

The Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) has revealed that each of the 109 senators in the National Assembly earns N1,063,860 million salary and allowances per month.

RMAFC chairman, Mohammed Bello Shehu made the clarification in a statement on Tuesday.

He said the clarification was necessary in view of the recent statement made by Senator Shehu Sani, who was reported to have disclosed to the public that each senator collects monthly running cost of N13.5 million in addition to the monthly N750, 000.00 prescribed by RMAFC.

The commission gave the breakdown of the salary and allowances of each senator as: Basic Salary – ₦168,866:70; Motor Vehicle Fuelling and Maintenance Allowance – ₦126,650:00; Personal Assistant – ₦42,216:66; Domestic Staff -₦126,650:00; Entertainment – ₦50,660:00; Utilities – ₦50,660:00; Newspapers/Periodicals – ₦25,330:00; Wardrobe – ₦42,216,66:00; House Maintenance – ₦8,443.33:00 and Constituency Allowance – ₦422,166:66; respectively.

Shehu said RMAFC does not have the constitutional powers to enforce compliance with the proper implementation of the remuneration package of lawmakers.

“This lacuna is, however, being addressed by the National Assembly,” he said.

The RMAFC chief also said some allowances are regular while others are non-regular.

“Regular allowances are paid regularly with basic salary while non-regular allowances are paid as when due.

“For instance, Furniture allowance (₦6,079,200:00) and Severance Gratuity (₦6,079,200:00) are paid once in every tenure and Vehicle allowance (₦8,105,600:00) which is optional is a loan which the beneficiary has to pay before leaving office,” he added.

Economy

FirstBank Recognized for Excellence in ESG Investments with Euromoney Award

FirstBank Recognized for Excellence in ESG Investments with Euromoney Award

FirstBank has been awarded the 2024 Euromoney Award for its outstanding commitment to Environmental, Social, and Governance (ESG) investments in Nigeria, through innovative financial solutions and initiatives.

In a statement released Sunday, FirstBank announced that Euromoney recognized its significant progress in implementing an ESG management system, screening N4.2 trillion in new transactions for ESG risks in 2024.

FirstBank’s notable projects include a $10 million solar energy initiative to expand off-grid solar solutions in Africa and Asia via a pay-as-you-go model, aiding Nigeria’s green transition. Additionally, the bank invested N16 billion to develop four modular independent power plants for a major beer manufacturer, reducing reliance on diesel generators and lowering production costs.

The bank also launched a tree-planting campaign with the Nigeria Conservation Foundation, planting over 50,000 trees in 2024, underscoring its ESG commitment.

Mrs. Folake Ani-Mumuney, Group Head of Marketing and Corporate Communications, expressed the bank’s excitement over the award, stating, “This recognition is a testament to our commitment to enabling success in our employees, businesses, and communities. Sustainability drives our growth and innovation.”

Euromoney’s “Awards for Excellence” honor top banks and bankers who demonstrate exceptional differentiation in the global banking industry.

FirstBank has also recently received accolades as Best SME Bank in Nigeria, Best Bank in Africa, Best Private Bank in Nigeria, and Best Private Bank for Sustainable Investment in Africa by Global Finance.

-

Business1 year ago

Business1 year agoNew Rates: ‘I borrowed money to finance this business…’ – Petroleum Marketer cries out over Non-supply of products by the NNPCL

-

Health5 months ago

Health5 months agoOnly 58,000 doctors renewed licence out of 130,000 registered doctors – MDCN

-

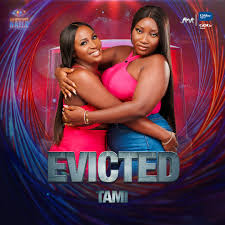

Entertainment2 months ago

Entertainment2 months agoBBNaija Season 9: TAMI Duo Evicted After Low Vote Count

-

Defence & Security1 month ago

Defence & Security1 month agoOrganisers Demand IGP’s Dismissal Over Fatal Protest Crackdown

-

Defence & Security1 month ago

Defence & Security1 month ago“Defence Chief Praises Strong Inter-Service Cooperation for Operational Successes”

-

Business2 years ago

Business2 years agoNew Naira Notes: We Have No Information On The Supreme Court Ruling – CBN

-

Opinion2 years ago

Opinion2 years agoAddressing Nigeria’s food security challenge through eco-friendly agriculture

-

Weather2 months ago

Weather2 months agoNiMet Forecasts 3 Days Thunderstorms, Rain Nationwide