Business

CBN defers 293rd MPC meeting again amid exoectations

CBN defers 293rd MPC meeting again amid exoectations

in spite of expectations by stakeholders, the Central Bank of Nigeria (CBN) have shelved its bi-monthly Monetary Policy Committee (MPC) meeting for the second time.

The meeting, expected to hold on Nov. 20 and Nov. 21, would have been the first to be presided over by Mr Yemi Cardoso as CBN governor.

This second postponement had kept stakeholders in suspense as to what Cardoso’s approach to bridging the exchange rates and addressing rising inflation would be.

The reports gathered that the MPC meeting, which is the 293rd in the series was earlier scheduled for September but postponed indefinitely.

At the 292nd meeting on July 24 and July 25, presided over by erstwhile acting CBN governor, Folashodun Shonubi, the committee decided to raise the Monetary Policy Rate (MPR) from 18.5 per cent to 18.75 per cent.

It also adjusted the asymmetric corridor to +100/-300 basis points around the MPR; retained the Cash Reserve Ratio (CRR) at 32.5 per cent; and retained the Liquidity Ratio at 30 per cent

According to Uche Uwaleke, a Professor of Capital Market at the Nasarawa State University, Keffi, the postponement of the MPC for the second consecutive time could be a blessing in disguise.

Uwaleke, also the President of the Capital Market Academics of Nigeria, said that if the MPC had held in September, it was most likely the MPR would have been jerked up thereby, further increasing the cost of doing business and reducing access to credit.

Read Also: Shun Reckless Lifestyle, Makinde Tells Corps Members

“This would have been the outcome of the meeting against the backdrop of the pressure by the IMF for an MPR hike to reduce money supply.

“It would not have had any significant impact on the rising inflation,” he said.

A past president of the Chattered Institute of Bankers of Nigeria (CIBN), Mr Okechukwu Unegbu, said that MPC meeting was an ongoing process.

“Maybe the committee has not exhausted the outcome of the last meeting in July.

“Cardoso is a technocrat; he knows what to do. I believe he is settling down and trying to understand where he is. He needs to study the environment properly before getting down to business.

“I think that is what Cardoso is doing. We should give him some time, but the politicians should allow him to do his job without interference, ” Unegbu said.

The Chief Executive Officer of the Centre for the Promotion of Private Enterprises, Muda Yusuf, said that the meeting must urgently be reconvened to give information about the economy and guide the public on the government policy direction.

According to Yusuf, because the leadership of the bank is new, I imagine that they are trying to put their acts together at least to familiarise themselves with the issues.

“The most challenging issue is the foreign exchange and they have been taking some steps even without meeting, trying to clear the backlog, which is commendable.

“The MPC gives information about the economy and the direction they are going, so the fact they have not met means there is a lack of communication.

“Monetary policy communication is important to guide investors and to that extent, it is important to have those meetings,” he said.

CBN defers 293rd MPC meeting again amid exoectations

Business

NNPC Denies $6.8 Billion Debt Allegation and Defends Federation Account Remittances

NNPC Denies $6.8 Billion Debt Allegation and Defends Federation Account Remittances

On Sunday, the Nigerian National Petroleum Company Limited (NNPC Ltd) refuted claims of a $6.8 billion debt to international traders. In a statement, Olufemi Soneye, Chief Corporate Communications Officer, clarified that the company does not owe the reported sum.

The NNPC Ltd’s response followed allegations that it has not contributed any funds to the Federation Account since January. Soneye emphasized that such claims are false, asserting that the company and its subsidiaries consistently remit taxes to the Federal Inland Revenue Service (FIRS).

Soneye explained that while NNPC Ltd manages numerous open trade credit lines, it adheres to a first-in-first-out payment approach for its obligations. He also highlighted that the company is a major contributor to the Federation Account Allocation Committee (FAAC) through its tax contributions.

Regarding the quality and quantity of imported petroleum products, Soneye clarified that NNPC Ltd does not oversee these matters, as this falls under the purview of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), an independent body.

The statement reinforced NNPC Ltd’s commitment to transparency and accountability, in line with the company’s TAPE (Transparency, Accountability, and Performance Excellence) philosophy.

Business

Naira rebounds, gains N28.15 against dollar

Naira rebounds, gains N28.15 against dollar

The Naira on Tuesday closed the month of April on a good footing as it gained N28.15 at the official market, trading at N1,390.96 to the dollar.

Data from the official trading platform of the FMDQ Exchange, a platform that oversees the Nigerian Autonomous Foreign Exchange Market (NAFEM), revealed that the gain represented a 1.98 per cent appreciation for Naira.

The percentage increase is significant when compared to the previous trading date on Monday, April 29.

The local currency experienced about two weeks steady fall by exchanging at N1,419 to a dollar.

The success story was replicated in the volume of currency traded, as the total daily turnover increased.

The daily turnover stood at 225.36 million dollars on Tuesday up from 147.83 million dollars recorded on Monday.

Meanwhile, at the Investor’s and Exporter’s (I&E) window, the Naira traded between N1,450 and N1,200 against the dollar.

Naira rebounds, gains N28.15 against dollar

Business

Naira appreciate, gains further by 1.8% against dollar

Naira appreciate, gains further by 1.8% against dollar

The Naira experienced a further appreciation at the official market, trading at N1,382.95 to a dollar on Tuesday.

Data from the official trading platform of the FMDQ revealed that the Naira strengthened by N25.09 or 1.78 per cent, compared to the previous day’s rate of N1,408 against the dollar.

Read Also: Pay Hajj Fare Based On Dollar Exchange Rate, NAHCON Advises Pilgrims

However, the total turnover increased to $245.58 million on Tuesday, up from $222.15 million recorded on Monday.

Meanwhile, at the Investor’s and Exporters’ (I&E) window, the Naira traded between N1,486 and N1,300 against the dollar.

The reports gathered that the Central Bank of Nigeria(CBN) had, earlier on Tuesday at its 294th Monetary Policy Committee (MPC), raised Monetary Policy Rate (MPR), by 200 basis points from 22.75 per cent to 24.75 per cent.

CBN governor Yemi Cardoso said that was meant to tackle the nation’s rising inflation.

Naira appreciate, gains further by 1.8% against dollar

-

Health5 months ago

Health5 months agoOnly 58,000 doctors renewed licence out of 130,000 registered doctors – MDCN

-

Business1 year ago

Business1 year agoNew Rates: ‘I borrowed money to finance this business…’ – Petroleum Marketer cries out over Non-supply of products by the NNPCL

-

Entertainment2 months ago

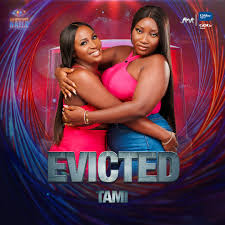

Entertainment2 months agoBBNaija Season 9: TAMI Duo Evicted After Low Vote Count

-

Defence & Security1 month ago

Defence & Security1 month agoOrganisers Demand IGP’s Dismissal Over Fatal Protest Crackdown

-

Defence & Security1 month ago

Defence & Security1 month ago“Defence Chief Praises Strong Inter-Service Cooperation for Operational Successes”

-

Business2 years ago

Business2 years agoNew Naira Notes: We Have No Information On The Supreme Court Ruling – CBN

-

Weather2 months ago

Weather2 months agoNiMet Forecasts 3 Days Thunderstorms, Rain Nationwide

-

National1 month ago

National1 month agoNNPCL CEO Kyari Promises to Reveal Truth Amid Economic Sabotage Allegations