Economy

Naira Swap-CBN bows to pressure, extends deadline by 10 days

Naira Swap-CBN bows to pressure, extends deadline by 10 days

The Central Bank of Nigeria has extended the deadline for the swapping of old naira notes till February 10, 2023.

RELATED STORY: Residents of FCT react to increasing cost of kerosene

The CBN stated this in a release on Sunday.

Details later…

Naira Swap-CBN bows to pressure, extends deadline by 10 days

Business

NNPC Denies $6.8 Billion Debt Allegation and Defends Federation Account Remittances

NNPC Denies $6.8 Billion Debt Allegation and Defends Federation Account Remittances

On Sunday, the Nigerian National Petroleum Company Limited (NNPC Ltd) refuted claims of a $6.8 billion debt to international traders. In a statement, Olufemi Soneye, Chief Corporate Communications Officer, clarified that the company does not owe the reported sum.

The NNPC Ltd’s response followed allegations that it has not contributed any funds to the Federation Account since January. Soneye emphasized that such claims are false, asserting that the company and its subsidiaries consistently remit taxes to the Federal Inland Revenue Service (FIRS).

Soneye explained that while NNPC Ltd manages numerous open trade credit lines, it adheres to a first-in-first-out payment approach for its obligations. He also highlighted that the company is a major contributor to the Federation Account Allocation Committee (FAAC) through its tax contributions.

Regarding the quality and quantity of imported petroleum products, Soneye clarified that NNPC Ltd does not oversee these matters, as this falls under the purview of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), an independent body.

The statement reinforced NNPC Ltd’s commitment to transparency and accountability, in line with the company’s TAPE (Transparency, Accountability, and Performance Excellence) philosophy.

Economy

Revenue Commission Discloses Senators’ N1M Monthly Salary, N12M Allowances; Highlights Disparity with N70,000 Minimum Wage

Revenue Commission Discloses Senators’ N1M Monthly Salary, N12M Allowances; Highlights Disparity with N70,000 Minimum Wage

The Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) has revealed that each of the 109 senators in the National Assembly earns N1,063,860 million salary and allowances per month.

RMAFC chairman, Mohammed Bello Shehu made the clarification in a statement on Tuesday.

He said the clarification was necessary in view of the recent statement made by Senator Shehu Sani, who was reported to have disclosed to the public that each senator collects monthly running cost of N13.5 million in addition to the monthly N750, 000.00 prescribed by RMAFC.

The commission gave the breakdown of the salary and allowances of each senator as: Basic Salary – ₦168,866:70; Motor Vehicle Fuelling and Maintenance Allowance – ₦126,650:00; Personal Assistant – ₦42,216:66; Domestic Staff -₦126,650:00; Entertainment – ₦50,660:00; Utilities – ₦50,660:00; Newspapers/Periodicals – ₦25,330:00; Wardrobe – ₦42,216,66:00; House Maintenance – ₦8,443.33:00 and Constituency Allowance – ₦422,166:66; respectively.

Shehu said RMAFC does not have the constitutional powers to enforce compliance with the proper implementation of the remuneration package of lawmakers.

“This lacuna is, however, being addressed by the National Assembly,” he said.

The RMAFC chief also said some allowances are regular while others are non-regular.

“Regular allowances are paid regularly with basic salary while non-regular allowances are paid as when due.

“For instance, Furniture allowance (₦6,079,200:00) and Severance Gratuity (₦6,079,200:00) are paid once in every tenure and Vehicle allowance (₦8,105,600:00) which is optional is a loan which the beneficiary has to pay before leaving office,” he added.

Economy

FirstBank Recognized for Excellence in ESG Investments with Euromoney Award

FirstBank Recognized for Excellence in ESG Investments with Euromoney Award

FirstBank has been awarded the 2024 Euromoney Award for its outstanding commitment to Environmental, Social, and Governance (ESG) investments in Nigeria, through innovative financial solutions and initiatives.

In a statement released Sunday, FirstBank announced that Euromoney recognized its significant progress in implementing an ESG management system, screening N4.2 trillion in new transactions for ESG risks in 2024.

FirstBank’s notable projects include a $10 million solar energy initiative to expand off-grid solar solutions in Africa and Asia via a pay-as-you-go model, aiding Nigeria’s green transition. Additionally, the bank invested N16 billion to develop four modular independent power plants for a major beer manufacturer, reducing reliance on diesel generators and lowering production costs.

The bank also launched a tree-planting campaign with the Nigeria Conservation Foundation, planting over 50,000 trees in 2024, underscoring its ESG commitment.

Mrs. Folake Ani-Mumuney, Group Head of Marketing and Corporate Communications, expressed the bank’s excitement over the award, stating, “This recognition is a testament to our commitment to enabling success in our employees, businesses, and communities. Sustainability drives our growth and innovation.”

Euromoney’s “Awards for Excellence” honor top banks and bankers who demonstrate exceptional differentiation in the global banking industry.

FirstBank has also recently received accolades as Best SME Bank in Nigeria, Best Bank in Africa, Best Private Bank in Nigeria, and Best Private Bank for Sustainable Investment in Africa by Global Finance.

-

Health5 months ago

Health5 months agoOnly 58,000 doctors renewed licence out of 130,000 registered doctors – MDCN

-

Business1 year ago

Business1 year agoNew Rates: ‘I borrowed money to finance this business…’ – Petroleum Marketer cries out over Non-supply of products by the NNPCL

-

Entertainment2 months ago

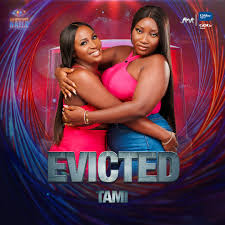

Entertainment2 months agoBBNaija Season 9: TAMI Duo Evicted After Low Vote Count

-

Defence & Security1 month ago

Defence & Security1 month agoOrganisers Demand IGP’s Dismissal Over Fatal Protest Crackdown

-

Defence & Security1 month ago

Defence & Security1 month ago“Defence Chief Praises Strong Inter-Service Cooperation for Operational Successes”

-

Business2 years ago

Business2 years agoNew Naira Notes: We Have No Information On The Supreme Court Ruling – CBN

-

Weather2 months ago

Weather2 months agoNiMet Forecasts 3 Days Thunderstorms, Rain Nationwide

-

National1 month ago

National1 month agoNNPCL CEO Kyari Promises to Reveal Truth Amid Economic Sabotage Allegations