Business

Old Naira: CBN advises traders to embrace use of POS to beat deadline

Old Naira: CBN advises traders to embrace use of POS to beat deadline

The Central Bank of Nigeria (CBN) has advised market traders and business operators in Kwara to embrace use of Point of Sale (POS) machines for transaction to beat the old Naira notes submission deadline rush.

The CBN, Ilorin Branch Controller, Mr Najim Lamidi, gave the advice at the Day Two of the sensitisation programme on redesigned Naira notes of N1,000, N500 and N200 among traders in Ilorin on Friday.

He said that doing such would encourage cash management and reduce security risks of holding physical cash in business transactions.

RELATED STORY: Brazil’s Defender Dani Alves In Policy Custody Over S3xual Assault Allegations

The CBN boss also advised the traders to discourage their customers from paying for goods with cash, saying that they should spread the message among their colleagues.

Lamidi further cautioned the traders to note that some of their customers may want to dump old Naira notes with them after expiration of the Jan. 31 deadline.

He said that the apex bank would not extend deadline on the redesigned notes beyond Jan. 31, 2023, and urged the traders and other members of the public to take their old Naira notes to banks or POS agents.

The CBN boss explained that the rationale for the redesign of Naira notes was that data had shown a large volume of banknote hoarding by the public, which led to a shortage of clean and fit banknotes.

The Iyaloja of Mandate market, Alhaja Funmilayo Baba-Kobi, promised to spread the message among members in the markets.

The News Agency of Nigeria (NAN) reports that the sensitisation programme was attended by market leaders and traders from Sawmill, Mandate, Awodi, Lasoju, Ipata and Eyenkorin markets.

The CBN team also took the sensitisation campaign to members of the Christian Association of Nigeria (CAN) and Federation of Muslim Women Association (FOMWAN) in Ilorin.

Old Naira: CBN advises traders to embrace use of POS to beat deadline

Business

NNPC Denies $6.8 Billion Debt Allegation and Defends Federation Account Remittances

NNPC Denies $6.8 Billion Debt Allegation and Defends Federation Account Remittances

On Sunday, the Nigerian National Petroleum Company Limited (NNPC Ltd) refuted claims of a $6.8 billion debt to international traders. In a statement, Olufemi Soneye, Chief Corporate Communications Officer, clarified that the company does not owe the reported sum.

The NNPC Ltd’s response followed allegations that it has not contributed any funds to the Federation Account since January. Soneye emphasized that such claims are false, asserting that the company and its subsidiaries consistently remit taxes to the Federal Inland Revenue Service (FIRS).

Soneye explained that while NNPC Ltd manages numerous open trade credit lines, it adheres to a first-in-first-out payment approach for its obligations. He also highlighted that the company is a major contributor to the Federation Account Allocation Committee (FAAC) through its tax contributions.

Regarding the quality and quantity of imported petroleum products, Soneye clarified that NNPC Ltd does not oversee these matters, as this falls under the purview of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), an independent body.

The statement reinforced NNPC Ltd’s commitment to transparency and accountability, in line with the company’s TAPE (Transparency, Accountability, and Performance Excellence) philosophy.

Business

Naira rebounds, gains N28.15 against dollar

Naira rebounds, gains N28.15 against dollar

The Naira on Tuesday closed the month of April on a good footing as it gained N28.15 at the official market, trading at N1,390.96 to the dollar.

Data from the official trading platform of the FMDQ Exchange, a platform that oversees the Nigerian Autonomous Foreign Exchange Market (NAFEM), revealed that the gain represented a 1.98 per cent appreciation for Naira.

The percentage increase is significant when compared to the previous trading date on Monday, April 29.

The local currency experienced about two weeks steady fall by exchanging at N1,419 to a dollar.

The success story was replicated in the volume of currency traded, as the total daily turnover increased.

The daily turnover stood at 225.36 million dollars on Tuesday up from 147.83 million dollars recorded on Monday.

Meanwhile, at the Investor’s and Exporter’s (I&E) window, the Naira traded between N1,450 and N1,200 against the dollar.

Naira rebounds, gains N28.15 against dollar

Business

Naira appreciate, gains further by 1.8% against dollar

Naira appreciate, gains further by 1.8% against dollar

The Naira experienced a further appreciation at the official market, trading at N1,382.95 to a dollar on Tuesday.

Data from the official trading platform of the FMDQ revealed that the Naira strengthened by N25.09 or 1.78 per cent, compared to the previous day’s rate of N1,408 against the dollar.

Read Also: Pay Hajj Fare Based On Dollar Exchange Rate, NAHCON Advises Pilgrims

However, the total turnover increased to $245.58 million on Tuesday, up from $222.15 million recorded on Monday.

Meanwhile, at the Investor’s and Exporters’ (I&E) window, the Naira traded between N1,486 and N1,300 against the dollar.

The reports gathered that the Central Bank of Nigeria(CBN) had, earlier on Tuesday at its 294th Monetary Policy Committee (MPC), raised Monetary Policy Rate (MPR), by 200 basis points from 22.75 per cent to 24.75 per cent.

CBN governor Yemi Cardoso said that was meant to tackle the nation’s rising inflation.

Naira appreciate, gains further by 1.8% against dollar

-

Health5 months ago

Health5 months agoOnly 58,000 doctors renewed licence out of 130,000 registered doctors – MDCN

-

Business1 year ago

Business1 year agoNew Rates: ‘I borrowed money to finance this business…’ – Petroleum Marketer cries out over Non-supply of products by the NNPCL

-

Entertainment2 months ago

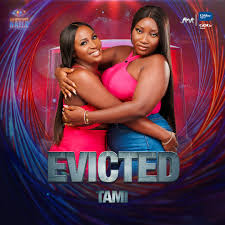

Entertainment2 months agoBBNaija Season 9: TAMI Duo Evicted After Low Vote Count

-

Defence & Security1 month ago

Defence & Security1 month agoOrganisers Demand IGP’s Dismissal Over Fatal Protest Crackdown

-

Defence & Security1 month ago

Defence & Security1 month ago“Defence Chief Praises Strong Inter-Service Cooperation for Operational Successes”

-

Business2 years ago

Business2 years agoNew Naira Notes: We Have No Information On The Supreme Court Ruling – CBN

-

Weather2 months ago

Weather2 months agoNiMet Forecasts 3 Days Thunderstorms, Rain Nationwide

-

Opinion2 years ago

Opinion2 years agoAddressing Nigeria’s food security challenge through eco-friendly agriculture