Economy

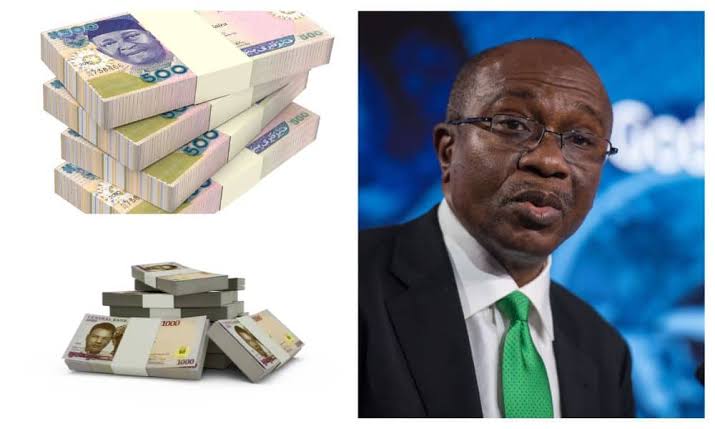

Buhari To Unveil Redesigned Naira Notes On Wednesday – Emefiele

Buhari To Unveil Redesigned Naira Notes On Wednesday – Emefiele

The Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele on Tuesday said President Muhammadu Buhari will unveil newly designed N1,000, N500 and N200 notes on Wednesday, November 23, 2022.

Emefiele made this known during the apex bank’s Monetary Policy Committee monthly meeting in Abuja.

According to him, the CBN won’t shift its deadline for all old notes to be returned to commercial banks in exchange for newly designed ones.

RELATED STORY: 2023: Wike Presents Rivers’ N550.6B Budget

The CBN MPC also hiked monetary policy to 16.5% from 15.5% while all other parameters remained unchanged.

Emefiele had on October 26, 2022 said the apex bank will issue redesigned N200, N500, and N1,000 notes, effective December 15, 2022, while the new and existing currencies will remain legal tender and circulate together until January 31, 2023.

However, he made a U-turn on Tuesday, saying the CBN won’t wait till December 15 anymore as the President will unveil the new notes on Wednesday.

The bank chief said, “100 days is enough for any person from any part of Nigeria to deposit his money in the bank and get his money when the new notes are released.

“For information, indeed, we are no longer waiting till December 15th to unveil and begin to release the new notes.

“By the special grace of God, tomorrow, which is the 23rd of November 2022, the President has graciously accepted to unveil the new currencies and the new currencies will be unveiled tomorrow at the Federal Executive Chamber by 10am.”

Buhari To Unveil Redesigned Naira Notes On Wednesday – Emefiele

Economy

Fuel subsidy was removed for Nigeria not to go bankrupt – Tinubu

Fuel subsidy was removed for Nigeria not to go bankrupt – Tinubu

President Bola Tinubu has said that fuel subsidy was removed to save the country from going bankrupt.

Speaking as one of the panelists at the ongoing World Economic Forum in Riyadh, Saudi Arabia on Sunday, April 28, Tinubu said he was convinced it was in the best interest of the people.

He said; “For Nigeria, we are immensely consistent with belief that the economic collaboration and inclusiveness are necessary to engender stability in the rest of the world.

“Concerning the question of the subsidy removal, there is no doubt that it was a necessary action for my country not to go bankrupt, to reset the economy and pathway to growth.

“It is going to be difficult, but the hallmark of leadership is taking difficult decisions at the time it ought to be taken decisively. That was necessary for the country.

“Yes, there will be blowback, there is expectation that the difficulty in it will be felt by greater number of the people, but once I believe it is their interest that is the focus of the government, it is easier to manage and explain the difficulties.

“Along the line, there is a parallel arrangement to really cushion the effect of the subsidy removal on the vulnerable population of the country. We share the pain across board, we cannot but include those who are vulnerable.

“Luckily, we have a very vibrant youthful population interested in discoveries by themselves and they are highly ready for technology, good education committed to growth.

“We are able to manage that and partition the economic drawback and the fallout of subsidy removal.”

The President who stated that fuel subsidy removal engendered accountability, transparency and physical discipline for the country, also talked about exchange rate unification.

According to President Tinubu, the management of the nation’s currency by the government was as well necessary to allow the Naira compete favourably with other world currencies.

He said; “The currency management was necessary equally to remove the artificial elements of value in our currency. Let our local currency find its level and compete with the rest of the world currency and remove arbitrage, corruption and opaqueness.

“That we did at the same time. That is two engine problem in a very template situation for the government, but we are able to manage that turbulence because we are prepared for inclusivity in governance and rapid communication with the public to really see what is necessary and what you must do.”

Fuel subsidy was removed for Nigeria not to go bankrupt – Tinubu

Business

Naira appreciate, gains further by 1.8% against dollar

Naira appreciate, gains further by 1.8% against dollar

The Naira experienced a further appreciation at the official market, trading at N1,382.95 to a dollar on Tuesday.

Data from the official trading platform of the FMDQ revealed that the Naira strengthened by N25.09 or 1.78 per cent, compared to the previous day’s rate of N1,408 against the dollar.

Read Also: Pay Hajj Fare Based On Dollar Exchange Rate, NAHCON Advises Pilgrims

However, the total turnover increased to $245.58 million on Tuesday, up from $222.15 million recorded on Monday.

Meanwhile, at the Investor’s and Exporters’ (I&E) window, the Naira traded between N1,486 and N1,300 against the dollar.

The reports gathered that the Central Bank of Nigeria(CBN) had, earlier on Tuesday at its 294th Monetary Policy Committee (MPC), raised Monetary Policy Rate (MPR), by 200 basis points from 22.75 per cent to 24.75 per cent.

CBN governor Yemi Cardoso said that was meant to tackle the nation’s rising inflation.

Naira appreciate, gains further by 1.8% against dollar

Business

Petroleum Ministry, NNPC Ltd., others brainstorm on oil, gas development

Petroleum Ministry, NNPC Ltd., others brainstorm on oil, gas development

Retreat

The Ministry of Petroleum Resources as well as its agencies and parastatals are expected to brainstorm on emerging developments in the oil and gas industry, at a sectoral retreat scheduled to hold in Abuja.

Mrs Oluwakemi Ogunmakinwa, Deputy Director, Press and Public Relations, Ministry of Petroleum Resources, said in a statement on Sunday that the retreat would focus on the Ministerial Deliverables (2023-2027) for the oil and gas sector.

Read Also: Veteran Nollywood Actor, Amaechi Muonagor, Dies At 62

The retreat with the theme: “Building Synergy for Enhanced Development in the Oil and Gas Sector” would hold between March 26 and March 28.

Ogunmakinwa stated that the retreat would also fashion the way forward for the industry as earmarked by President Bola Tinubu.

“In the course of the retreat, heads of agencies under the ministry will be required to make presentations on the mandate, vision and mission of their respective organisations,” she stated.

According to Ogunmakinwa, the Minister of State Petroleum Resources (Oil), Sen. Heineken Lokpobiri and the Minister of State Petroleum Resources (Gas), Mr Ekperikpe Ekpo will be attending the retreat.

The Permanent Secretary, Ministry of Petroleum Resources, Amb. Nicholas Agbo Ella, Directors in the Ministry, as well as the Chief Executive Officers (CEOs) and Directors from the Agencies under the supervision of the Ministry would also be in attendance.

It would be recalled that President Bola Tinubu had the first year Ministerial Retreat with Ministers, Presidential Aides, Permanent Secretaries and top government functionaries from Nov. 1 to Nov. 3, 2023.

The retreat by the president was to chart a path for progress and prosperity of the nation, where he charged the participants to deliver on their mandates for the sake of Nigerians.

Petroleum Ministry, NNPC Ltd., others brainstorm on oil, gas development

-

Education10 months ago

Education10 months agoMathematics Teacher Reportedly Stung By Bee While Preparing Students For Exam

-

Health3 weeks ago

Health3 weeks agoOnly 58,000 doctors renewed licence out of 130,000 registered doctors – MDCN

-

News1 year ago

News1 year ago3 escape death in Ore-Sagamu expressway accident

-

Politics3 weeks ago

Politics3 weeks agoAPC IN A FIX AS GOVERNORSHIP ASPIRANTS REJECT THE ONDO STATE PRIMARY ELECTION RESULTS

-

Crime2 weeks ago

Crime2 weeks agoPolice arrest cultists who killed rival in his daughter’s presence

-

Sports2 weeks ago

Sports2 weeks agoAsaba to host Wheelchair Basketball Atlantic Conference League

-

Education3 weeks ago

Education3 weeks agoUTME: JAMB to refund registration fees to deserving visually-impaired candidates

-

National3 months ago

National3 months agoResidents gather to scoop engine oil as tanker falls in Ojuelegba